Quick Context 🔥

Who: Sam Dogen, Founder of FinancialSamurai

What: This post delves into the emotions and feelings that Sam had after selling his business. In the world of acquisitions, the feelings of regret we’re about to delve into are hardly ever talked about. I think one of the reasons is because the emotions conveyed here require tremendous vulnerability. But also…Who wants to hear someone being regretful after selling a business for close to 3M? Likely no one. So what ends up happening is that regretful founders who sold their business internalize and bottle up their feelings...So they never come to light. These are his thoughts and words with my comments intertwined throughout. Thank you Sam for your vulnerability and honest account into your journey.

Why This Matters: Humans are different but we’re not THAT different. It’s very likely that a high number of you will go through what Sam went through. Knowing this, it will help to prepare yourself mentally for when the time invariably comes. My goal for this post is to shed light on this often overlooked side of acquisitions.

LET’S BEGIN…🕵️♂️🔎

Quick Facts 💨

Cost to build his website in 2003: $1,000

Sale Price: $2.8M

Return on initial investment of $1k: 2,800X

Website tenure: 7 Years

My Main Takeaways:

Take a 3-6 month break after selling my business to re-evaluate goals, priorities and relationships.

Re-invest business proceeds into the stock market, real estate or buy another business.

Timing your business sale is key. Try to avoid selling in a down market, which is exactly what our friend Sam did.

Buyer: The website name and industry has been hidden to protect the privacy of the buyer and adhere to his non-disclosure clause.

Payment Structure: All cash

Sam…How did it feel to have sold your website:

“I’ll Always Regret Selling My Online Business” *gulp*

Three Things Sam is Most Proud of

“My wife for carrying and delivering their son. We have tried for several years to no avail. But she got through it and succeeded in delivering the best thing that has every happened to us.”

“My son for learning and figuring things out on his own. When he figures things out, his face lights up and so does my heart.”

“Keeping my promise in 2009 of writing three articles a week on Financial Samurai for 10 straight years. There were many times when I was dead tired from work or from being a stay at home dad, but I forged on.” 1

Tell me About the Founder 📖

Sam sold his first business in 2010 and started his second business, Financial Samurai in 2009 to help people achieve financial freedom sooner, rather than later. Financial Samurai is now one of the largest independently run personal finance sites with 1 million visitors a month.

He retired in 2012 and now generates roughly $250,000 passively. He enjoys being a stay-at-home dad to his two young children.

Why Did Sam Regret Selling his Business? 2

1) Felt like I had lost a child. 😲

Years before the birth of my son, I birthed my website. Selling the site made me depressed that I no longer had my baby to nurture. For almost seven years, I looked forward to working on my website before work and after work. When I got laid off in 2009, I spent 60 hours a week on the website.

Sometimes I spent way more time on my business than I did on my biological child. But that’s not a surprise because many working parents spend more time at work than raising their children too. I loved my business as much as I could love any child. When I sold the website, I felt like the worst father ever.

Selling something you love for money is a horrible feeling. You will only realize how much you love that something until it’s gone. If you feel nothing after you sell, then that is how you know you made the right decision.

It is common for founders to wrap their self image around their business. When this happens, their business becomes part of their identity. This is dangerous because you can lose your business and in turn get the sense that you have lost your identity. The better alternative is to constantly ensure that your self image and identity are wrapped around things that always within your control. When we wrap our identity around things we can’t control, we are bound to face a mountain of pain.

I used to wrap my identity around my performance at work and as soon as I started underperforming in aspects out of my control, everything went down…My eating habits, consistency and discipline suffered. I then developed a coping mechanism with Frozen Yoghurt…Don’t do that!! I repeat…Do not do that!

2) Lost my sense of purpose. 😳

I underestimated how important it was to look forward to having something to do every day. My business allowed me to reach the top of Maslow’s Hierarchy Of Need’s Pyramid. Once I sold, I could not recreate a similar site because I had a non-compete for one year. I could have created a new site in a different genre, but I was only passionate about the genre I was in.

Having no purpose led me to drink heavily and use recreational drugs much more often. I gained about 30 lbs over the next couple of years and constantly felt depressed. My relationship with my wife suffered and I began to resent my son for taking up so much of my time. It was bad for a couple years until I went to get some counseling.

For Sam his coping mechanism during this time was drinking, drugs and food. Unfortunately, other areas of his life took a hit as well. Being aware of ones mental health and developing healthy coping mechanisms can make the ultimate difference. A few healthy coping mechanisms are meditation, going for walks and working out. But ultimately, we need to find what works best for us. For some it might even be painting or knitting.

3) Lost a creative outlet. 🖌️ + 🎨

When we were kids, we’d always create something new in school – whether it was paper machete, clay figurines, or drawings, we were always using our minds to create. Once I sold my site, I tried to pick up guitar, but that didn’t last. I should have known because I’ve had my guitar gathering dust next to my bed for the past eight years.

Then I tried painting, but that was too messy. After a couple “works of art,” I gave up. All I wanted to do was write what I had been writing for the past seven years, but couldn’t for the first year.

Something I am absolutely terrible at is rest. I have this self narrative in my mind that rest is a waste of energy and has an opportunity cost to it. I resonate with Sam here and I wonder what I would have done differently. I wonder if I would have awarded myself and my family one or two months to travel and unplug.

4) I left so much money on the table. 💵💵💵

After I sold my site, I looked longingly at other sites in my space that kept on growing. I was envious for other people’s passion. I was also in awe that they were not so easily tempted by money to sell. Make no mistake, selling out is predominantly about the money.

It turns out, selling in 2010 was close to the bottom of the stock market, real estate market, and the economy. What a mistake!

The site had an operating profit of about $600,000 a year. At the time, I thought $2.5 million plus a $300,000 earn-out was a good price. But some of the sites that were smaller than mine kept on going to the point where they started making $1 million a year by 2019 and some as early as 2017. Not only that, valuations for websites went up too, along with the valuations of the S&P 500.

Even if my operating profits had been flat at $600,000 a year, if I had just held on for five more years I would have not only made $3,000,000 more in operating profits, I also could have sold my site for closer to $4,200,000 + a $600,000 earn out due to higher valuations.

If I was able to grow my operating profits to $1,000,000 a year like many of my peers, then I would have been able to sell my site for closer to $7,000,000 today versus $2,500,000. I would have also collected all those years of profits as well.

In essence, I left at least $5,000,000, and closer to $11,000,000 on the table if I could have just hung on until now!

Sam has told people in his post on doing retirement all over again, that life is long and to not be overly in a rush to retire early. He is right. Nine years later, I remember the day I signed the sale document like it was yesterday.

This is extra painful because unfortunately Sam timed the sale at perhaps the worst possible time. Checking other websites and calculating what he could have gotten just added salt to the wound.

5) I wasted my time trying to recreate a successful business. ⌛

During my year-long non-compete, I started three new businesses in different fields that failed. After my non-compete was over, I tried starting a couple other websites similar to the one I had. They also didn’t gain any traction.

All told, I wasted three years of my life trying to get back what I lost. It infuriates me to know that I could have spent those three years working on the site I sold and made even more money.

The lesson I am taking away from Sam’s experience is that it sounds like he didn’t take a break after selling his business. Note to self: When I sell my business for millions, you better believe my family and I will take a break. Re-evaluate life, re-think our goals and our priorities.

I also don’t like that he says he “wasted my time trying to recreate a successful business”…Come on, why not look at that time as practice he needed to build his current business, FinancialSamurai?

6) My baby was finally killed.

Four years after my site was purchased, the acquirer redirected my site to land on some other business they owned. Essentially, they killed my site and all the time I had put into it. I was foolish to think my site would live on forever once it was out of my control. Now, all that shows up are crappy articles that haven’t been updated in years.

As you get older, you start thinking about leaving a legacy for your children. Unfortunately, I cannot proudly tell my children this is what dad built because what dad built is gone. Creating a family business would have been a wonderful.

7) I started taking shortcuts that made me feel ashamed.

After about six years, I finally started gaining traction with a new site. But I have to admit, I’m not proud of the way I got here.

First of all, I did a lot of scammy link-building to try and game the search engines. Second, I started taking the ideas of many established sites and just copying their articles with my own spin. I even copied the way other established sites wrote their author bios with the same affiliate copy.

No longer was I trying to create something original. I hired a bunch of writers to pump out as much search-engine-friendly content as possible to make as much money as possible.

I also put a lot of advertising dollars behind my content even though I knew they were boring as sh*t because I had figured out a way to make more than my advertising costs. My modus operandi was to copy what was already successful. It felt icky.

What I appreciate most in his comments is his raw honesty. Since the 3 years after selling his business weren’t fruitful, he resorted to taking riskier bets to make up for the gains he thinks he lost. I wonder if it would have helped him to reframe his mindset to look at everything as an experiment where the main goal is to learn as much as possible. I bet this would have taken off the pressure and performance would have increased.

8) I became irrelevant in my community. 😔

When I had my site, everybody gave me the time of day. Journalists would ask me for a quote. I would be asked to come on podcasts or TV. Other bloggers would say nice things about me or my site. My offline friends would refer to me as a successful entrepreneur to friends.

Once I sold my site, I lost contact with many of my peers who I had thought were my friends. They were outwardly congratulatory about my sale, but behind my back, they stopped caring. I could no longer help promote their work so they stopped giving me any love. The podcast and interview requests stopped as well.

Once you lose what makes you valuable, you can recognize who your true friends are. I’m not one to need constant accolades, but it felt depressing to go from lots of respect and attention to nothing.

I decided to buy myself back into the conversation by sponsoring various activities in the community. I feel better now about getting recognized, but deep down I’m sad to not have more organic friendships in the community.

We touch on the theme of identity again here…His identity was fully immersed in his business and so were his friendships.

9) I didn’t fully reinvest my proceeds. 🤦♂️

I sold my business in 2010 because I was glad my business still had value after the devastating crash. In my mind, there was a good chance the market would crash again. Sam said he felt the same way in 2012, which is why he put his house on the market.

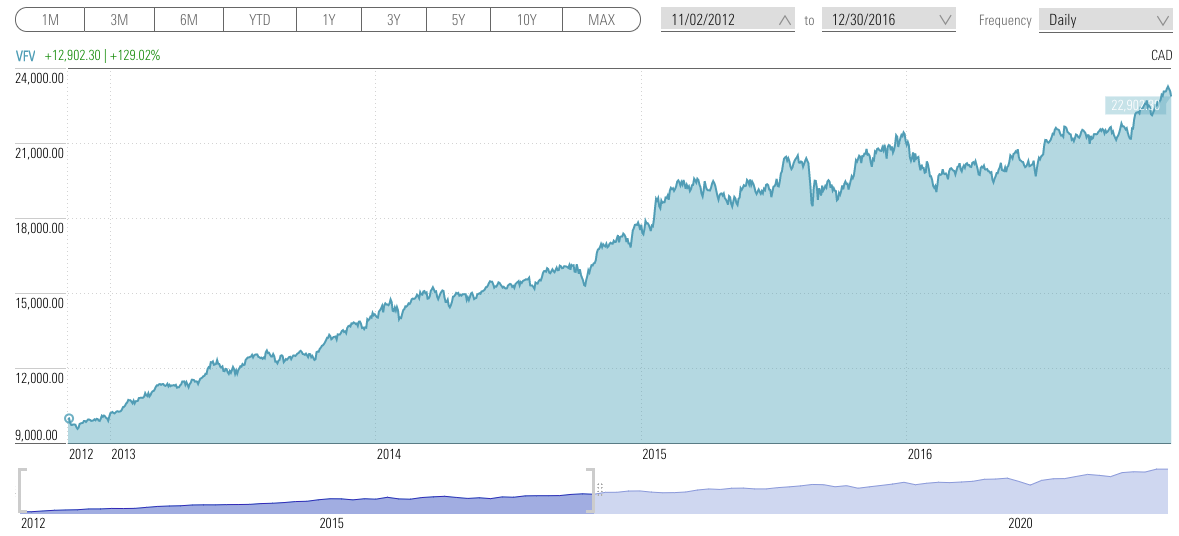

Given my fears of a double dip recession, after selling, I just held onto my proceeds in cash. It was not until 2016 did I invest about 50% of the proceeds.

By then, I had missed out on a very healthy rally that probably cost me more than $500,000 in lost gains. Talk about adding salt in the wound after already missing out on $5,000,000 – $11,000,000 if I had just held onto my site until now.

When you are presented with a windfall, it is much harder to reinvest these proceeds than you think. You are more afraid losing this money versus the money you invest every month from your paycheck.

Note to self: REINVEST PROCEEDS. Had he invested his $ he would have more than doubled it in just a matter of 6 years by investing in the S&P 500.

10) Taxes took so much away. 👎︎

Although I sold my business for $2.5 million (excluding the $300,000 earnout a year later), I only ended up with about $1.75 million after paying federal and state taxes. $1.75 million is still a nice chunk of change, but by selling your business, you are essentially surrendering yourself to the government.

When you are operating a business, you have a lot more flexibility to spend money to reduce your taxable income. You expense your flights and lodging to a conference in Paris. You can even buy an SUV or truck for your business and deduct the cost.

I calculate my average effective tax rate when running my business was closer to 20% versus the 30% I paid when I sold. Over the long term, this 10% effective tax rate difference really adds up.

This insight is often overlooked. There can be immense tax benefits to owning your own business. A 10% difference is huge, especially when compounded over time.

11. Don’t Ever Sell Your Profitable Online Business. 🤔

Maybe I’m being too hard on myself. Sure, the online business could have imploded if I didn’t sell. But if you’re doing things the right way and can clearly see a path to continued growth, there is no way you should ever sell a profitable online business.

As Sam says, cash flow positive businesses greatly increase in value during a declining interest rate environment because it takes more capital to generate the same amount of risk-free return.

It’s definitely tempting to sell an online business for a lot of money, especially in a really strong economy. But if you think about the biggest businesses in the world, they’ve been around for decades. For example, Coca Cola was founded in 1892. Mars Inc, a $60 billion company that makes M&Ms and pet food, was founded in 1911. The list goes on.

Many of the world’s largest companies have been through multiple down-cycles. But they kept on going and kept on reinventing themselves to make greater fortunes. Downturns are what made these companies stronger with new inventions, new strategies, and new ways of doing things.

When running an online business, start thinking about creating a multi-generational online business for your children to run. The longer-term you think, the better your online business should turn out.

With interest rates at rock bottom levels, the value of online businesses have gone way up. Why? Because online businesses generate strong cash flow and have big operating profit margins. It takes a lot more capital to generate the same amount of risk-adjusted income.

Further, online businesses are defensive because they are always open. The pandemic made it clear that having an online business is more valuable than having a brick and mortar business.

Sometimes you win, sometimes you lose. Sometimes you time things perfectly, sometimes you don’t. My biggest takeaway is: When I make a big mistake, I must move on. Reminiscing, lamenting and being disappointed in oneself creates a significant opportunity cost. His recommendation on, “don’t ever sell your online business” is way overblown and I don’t think is sound advice. I can see why he thinks he made a mistake and for all intents and purposes, I think he did.

I would also like to trace back and really seek to understand what made him want to sell in the first place? I bet that is the root of why he made this mistake, I wonder if it was quick irrational decision he caved into one day.

Would your friends benefit from reading about Sam’s feelings after selling his business? If so…why not share it? :)

My hopes is that you learned as much as I did during this analysis.

Say hi on LinkedIn & Twitter (@JaygerMcGough), collectively we’ll become smarter about buying and selling businesses.

Don’t forget to subscribe and thank you to the 22+ people who shared last weeks analysis with their friends, I appreciate you and trust this will also help them.

My lawyers told me to include this:

This newsletter is presented for informational purposes and educational purposes only and should not be construed as professional financial advice. Should you need such advice, consult a licensed financial or tax advisor. The newsletter is composed of opinions and is not intended to give investment advice.

https://www.financialsamurai.com/who-is-sam-dogen-founder-of-financial-samurai/

https://www.financialsamurai.com/why-i-regret-selling-my-online-business-for-millions-every-single-day/