Buyers & Sellers...Don't Miss These Tax Strategies

Learning these strategies can generate an outsized $ return on your investment of time

Quick Context 🔥

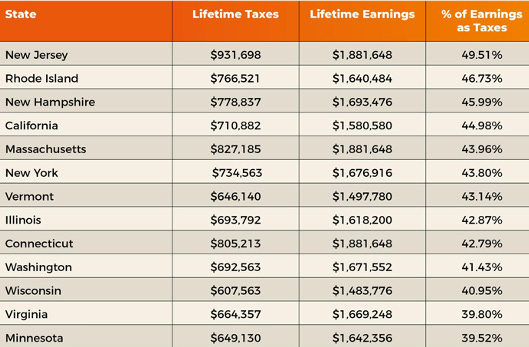

What: The average American will pay $525,037 in taxes throughout their lifetime. That’s an average of 34.3% of all lifetime earnings spent on taxes.1 Ugh…that’s a lot and it feels especially high when tax dollars are often mismanaged.

Also, that’s just the average American. Let’s just say you make $100k/year, your lifetime tax bill suddenly increases to more than $1,440,013. 2*psst*…These numbers are just conservative too and don’t bake in the assumption that taxes are set to drastically increase in the next 20-50 years.

How else will the U.S. pay the 27.78 trillion we have accumulated in public debt thus far? 3 Something to ponder.

The average single American contributed 29.8% of their earnings to three main taxes in 2019—Income taxes, Medicare, and Social Security

The average income tax rate for all Americans was 14.6% in 2017, according to the Tax Foundation’s method of calculation

Why Write This Post: Time spent learning about taxes and how to navigate them can produce an outsized ROI of time…and we’re all about outsized ROIs & opportunities.

Thank you: These findings were compiled from several sources, all of which have been referenced below. SBA.gov was the primary contributor to the content below with my comments intertwined.

Baby boomers own over 12 million businesses & 60% of owners plan to sell their business within the next decade.

Retiring Boomer business owners will sell, pass on or shut down $10 trillion worth of assets over the next two decades.4

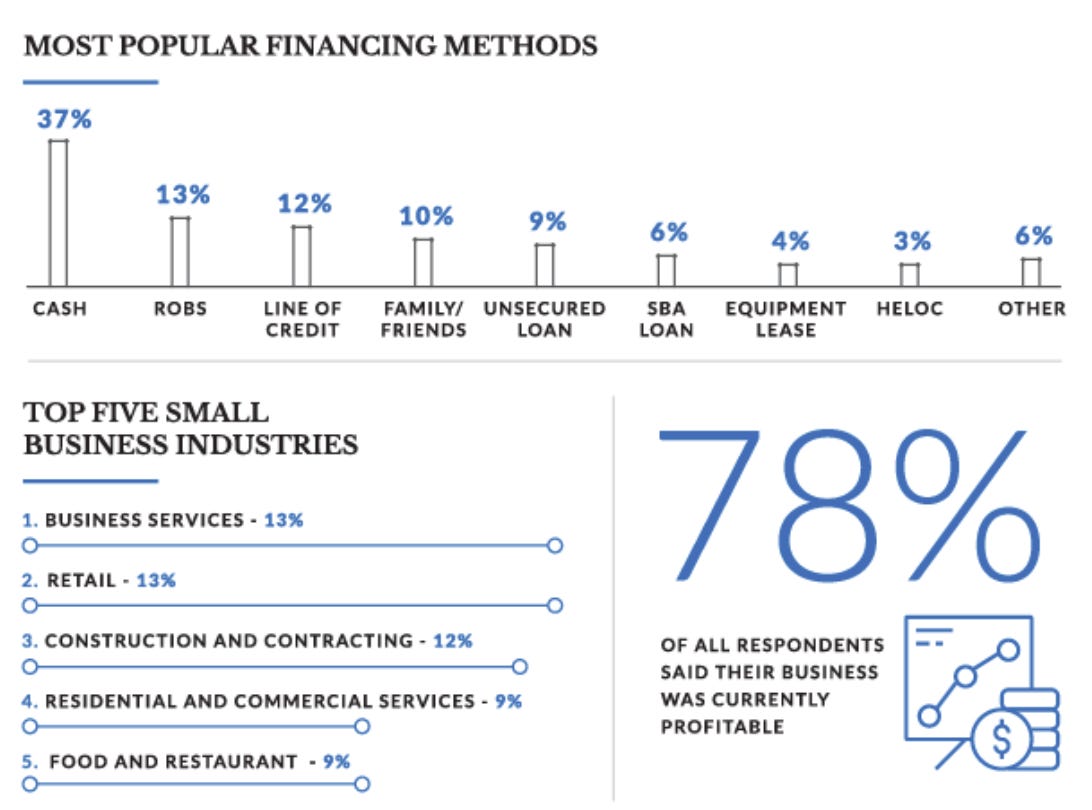

Ever wondered how people typically finance a business acquisition? [See Image Below]

The key message I took from this graphic is that there are plenty of ways to fund the acquisition of a business. One can mix & mingle these approaches.

Now let’s talk about the other side of this equation. Let’s say you’re looking to sell your business and wanting to ensure you don’t leave money on the table…In this case, we’ll be focusing on ways to manage your tax burden.

1. Negotiate everything for the sale of a sole proprietorship

If your business is a sole proprietorship, a sale is treated as if you sold each asset separately. Most of the assets trigger capital gains, which are taxed at favorable tax rates. But the sale of some assets, such as inventory, produce ordinary income. It’s up to the buyer & seller to negotiate the terms of the sale, which includes allocating the purchase price to the assets of the business.

IRS Form 8594, Asset Acquisition Statement, shows seven classes of assets to which you must allocate the purchase price. The first class includes cash and checking accounts, to which you allocate the purchase price dollar-for-dollar. The final class (class VII) is for goodwill and going-concern value. These are the intangible assets that command part of the purchase price. The more goodwill the business had, the greater the allocation to this class.

Keep in mind that allocation is a negotiation between you and the buyer. Why? The seller wants to allocate as much as possible to capital gain assets such as goodwill. While the buyer will typically want an allocation for assets, such as equipment and realty, that can be depreciated going forward. 5

Overall, you want to get to know the buyer or seller that you’re working with in the same way you’d get to know someone you’re dating. The goal is to form a relationship with the other person. This will reduce friction during every stage of the business transaction and make favorable scenarios like these more likely.

2. Sell a partnership interest

The sale of an interest in a partnership is treated as a capital asset transaction; it results in capital gain or loss. But the part of any gain or loss from unrealized receivables or inventory items will be treated as ordinary gain or loss. Capital gain deferral is possible through an Opportunity Zone investment (Read #7 below).

3. Decide on a corporate sale of stock or assets

If you own a corporation, there’s a choice in how to structure the sale: sell stock or characterize the transaction as a sale of assets. Generally, sellers like to sell the stock to limit the capital gains tax on the transaction. But buyers prefer an asset sale because this creates a higher basis for the depreciable assets that they’re acquiring. Keep in mind, negotiations between parties can resolve the structure of the sale. For example, a seller may be willing to take a little less for the business to complete a stock sale, reducing the higher tax bill that would have resulted from an asset sale. 6

Many business owners don’t know about these strategies. Which means that as a buyer, it is often up to you to really educate yourself and take ownership of understanding this process inside and out. Ultimately, your knowledge will benefit both parties tremendously.

4. Make a Selection

The characterization of the sale as a stock or asset sale applies equally to C and S corporations. But there are tax savings to be reaped by being an S-corp. Gain on the sale of a C-corp requires the owner to report an additional 3.8% Medicare tax on this net investment income. In contrast, if the business is an S corporation and the owner is actively involved in the business and not merely a silent investor, then the gain is not subject to this tax. A C-corp planning on a sale can make an S election where advisable, assuming the corporation meets the requirements for being an S-corp. 7

5. Use an installment sale

One of the ways to minimize the tax bite on profits from the sale of a business is to structure the deal as an installment sale. If at least one payment is received after the year of the sale, you automatically have an installment sale. But there are some points to keep in mind. You can’t apply installment sale reporting for the sale of inventory or receivables. Also, there’s always a risk in an installment sale arrangement that the buyer will default. Details on installment sales in the instructions to Form 6252. 8

You could sell the business for more by accepting to receiving installment payments during an agreed amount of time. This is particularly helpful because it also wouldn’t trigger a huge tax bill.

6. Sell the business to your employees

If your business is a C corporation and you plan ahead, you can sell your business to your staff through an employee stock ownership plans (ESOP). The ESOP is owned by employees (find more information about ESOPs from the IRS). From an owner’s perspective you have captive buyers and don’t have to search around. You set a reasonable price for the sale and receive cash from the ESOP. You can then roll over the proceeds into a diversified portfolio to defer tax on the gain.

You can also use ESOPs for S corporations, but the deferral option for an owner doesn’t apply. Revoking an S election in anticipation of a sale is something to consider.

Another benefit of selling to your employees is that they already know all the ins and outs of the business. Which means that all you’d need to do now is promote someone internally to become the operator or hire externally for one.

7. Reinvest Gains in an Opportunity Zone

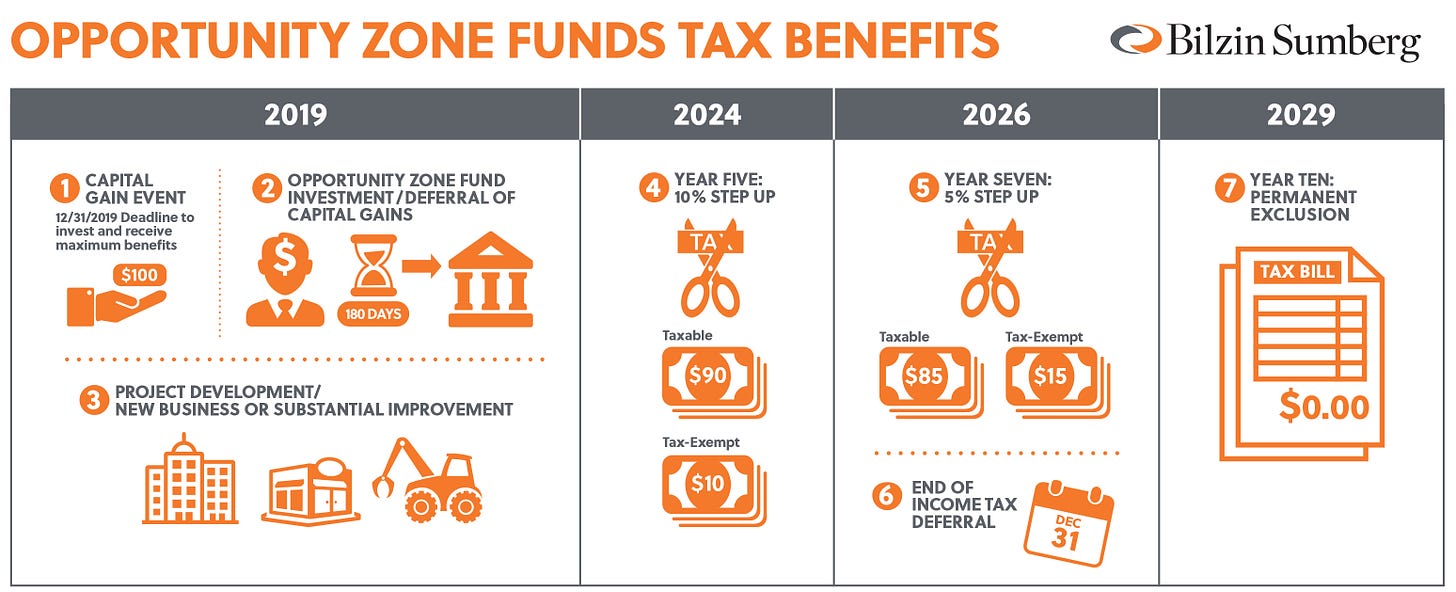

Owners who realize capital gains on the sale of their business can defer tax on that gain if they act within 180 days of the sale. They can reinvest their proceeds in an Opportunity Zone (you go into a Qualified Opportunity Zone (QOZ) Fund for this purpose).

Opportunity Zones are an economic development tool that allows people to invest in distressed areas in the U.S. Their purpose is to spur economic growth and job creation in low-income communities while providing tax benefits to investors. 9

Deferral is limited because gain must be recognized on December 31, 2026, or earlier if the interest in the fund is disposed before this date. Holding onto the investment beyond this date can result in tax-free gains on future appreciation. An owner who sells his or her business doesn’t have to put all the proceeds into a QOZ, but tax deferral is limited accordingly.

Final thoughts

Many business owners find it difficult to walk away from their businesses. They love the action and don’t have personal plans for their time in retirement. This could be an excellent opportunity to negotiate a consulting agreement with the buyer. This gives the departing owner ongoing income and continuing tax breaks (such as claiming the qualified business income deduction if eligible).

Would your friends benefit from reading this list of reminders? Even if they are years away from buying or selling a business? If so…why not share it? :)

My hopes is that you learned as much as I did during this analysis.

Say hi on LinkedIn & Twitter (@JaygerMcGough), collectively we’ll become smarter about buying and selling businesses.

Don’t forget to subscribe and thank you to the 12+ people who shared the last analysis with their friends, I appreciate you and trust this will also help them.

My lawyers told me to include this:

This newsletter is presented for informational purposes and educational purposes only and should not be construed as professional financial advice or Tax Advice. Should you need such advice, consult a licensed financial or tax advisor. The newsletter is composed of opinions and is not intended to give investment advice.

https://www.cpapracticeadvisor.com/tax-compliance/news/21211629/americans-pay-more-than-525000-in-tax-over-a-lifetime

https://www.forbes.com/sites/moneybuilder/2011/03/17/how-much-do-you-pay-in-taxes-over-your-lifetime/?sh=28dbdb706e95

https://www.statista.com/statistics/273294/public-debt-of-the-united-states-by-month/

https://cabb.org/news/baby-boomers-incredible-numbers-are-buying-and-selling-businesses-part-1-2

https://www.sba.gov/blog/7-tax-strategies-consider-when-selling-business

Ibid

Ibid

Ibid

Ibid