Due Diligence for a Mobile App Acquisition 📱

Featuring Ben Church's strategy to uncover a potential acquisition

Quick Context 🔥

Who: One of my friends, Ben Church has been acquiring small SaaS apps as a side hustle for the past year.

What: This post delves into the due diligence that Ben did when considering buying an Invoicing App. This is his process with my comments given throughout. Credit goes to him for his thoughtfulness and strategy.

Why This Matters: Learning about the due diligence process that others use can be a faster way to master the art of due diligence.

Types of Businesses Ben is after:

Must have one paying customer

Purchase price should be no more that 4x ARR

Cannot be replicate-able by no-code products i.e. Bubble.io

Opportunity for Expansion Revenue and Net Negative Churn

Support Time Per hour / Profit per hour should not be below $50

He evaluates products on a scale of 1-5 in the following areas:

Product Quality i.e How good is it?

Porter's Five Forces of Competition i.e How defendable is it?

Growth Potential i.e. How could we increase it's value?

Time Scale i.e. How reliable are current metrics?

LET’S BEGIN…🕵️♂️🔎

Quick Facts 💨

What does the Mobile App do: Invoicing Software (Web/iOS/Android) that allows small business owners to quickly and easily:

Create estimates

Send invoices

Request and receive payments

Record Expenses

Track financial health

Cost: $9.99/month or $49.99/year

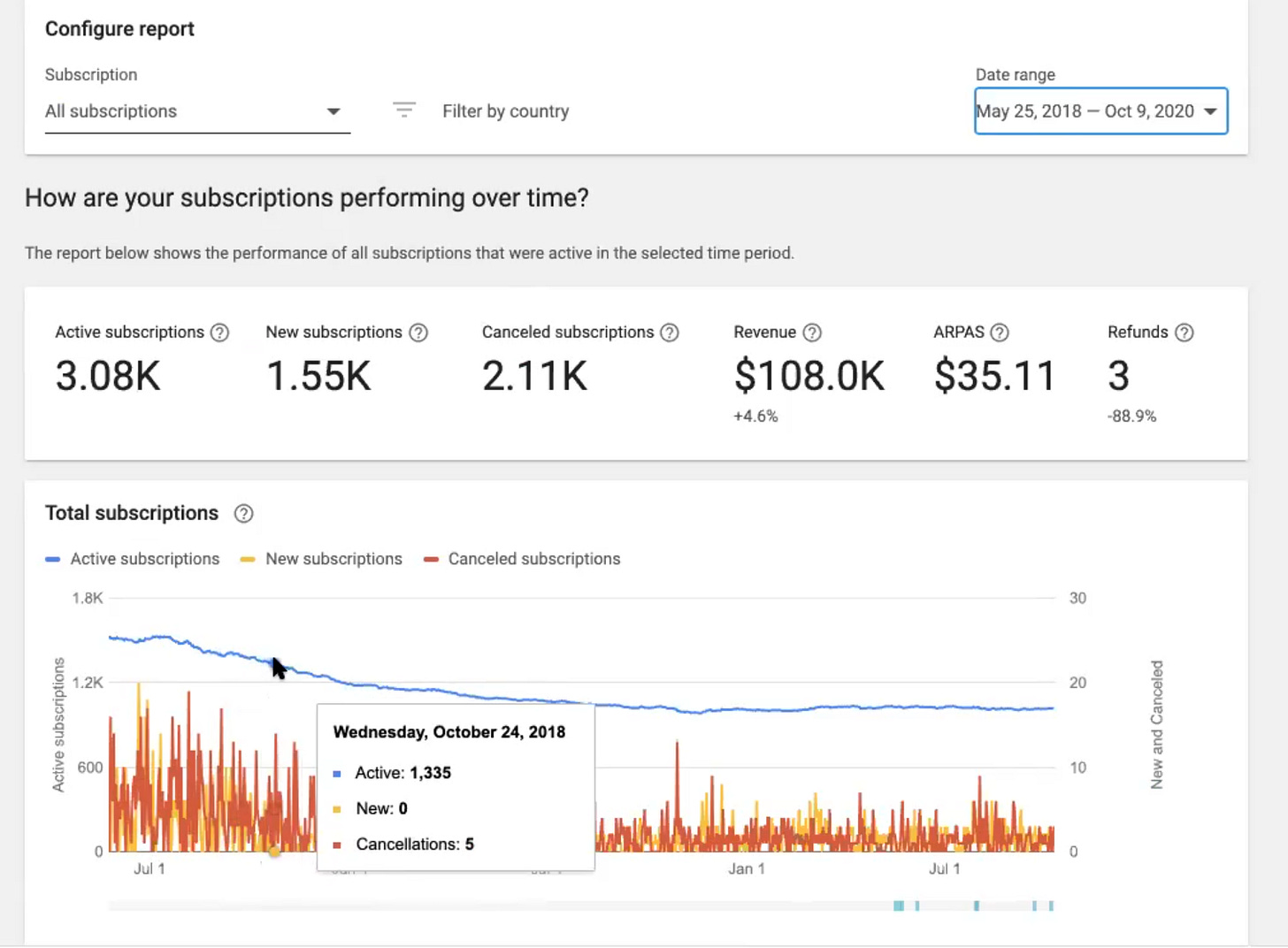

Active Subscribers: Approximately 1000 active subscriptions

Sale Price: $320,000 which at approximately $60,000 ARR

Multiple: 5.3x multiple

Ben’s Initial thoughts 🤔

“Invoicing has been around for awhile and I already use a free competitor to this app, so right away I'm a little skeptical of the product and the price tag.

Where's the dragon hiding 🐲?

Going into due diligence I've already got a few things on my mind:

High ARR multiple will need a solid track record to justify it, also are we sure we can grow it enough to justify the large price tag?

This is a crowded space with big players, can we avoid getting squashed?

How did he get these users? Is he holding onto them? Are new ones coming in?”

💡 Ben already uses an invoicing app, which immediately gives him a leg up during this evaluation process because he knows what to look for. This is the best case scenario for a business buyer. As a buyer, seek businesses that you understand the most and it will help identify potential pitfalls and strengths in the business.

9 Step Due Diligence Process 🔎

💡 One aspect I think you will also appreciate about Ben’s due diligence process is his methodology. When doing due diligence, it is key to come up with a simple, repeatable and scalable process. Why? Because you’ll likely go through 20-40 businesses before you find your diamond in the rough. 💎

💡 Having a process will let you analyze more businesses in less time and unemotionally.

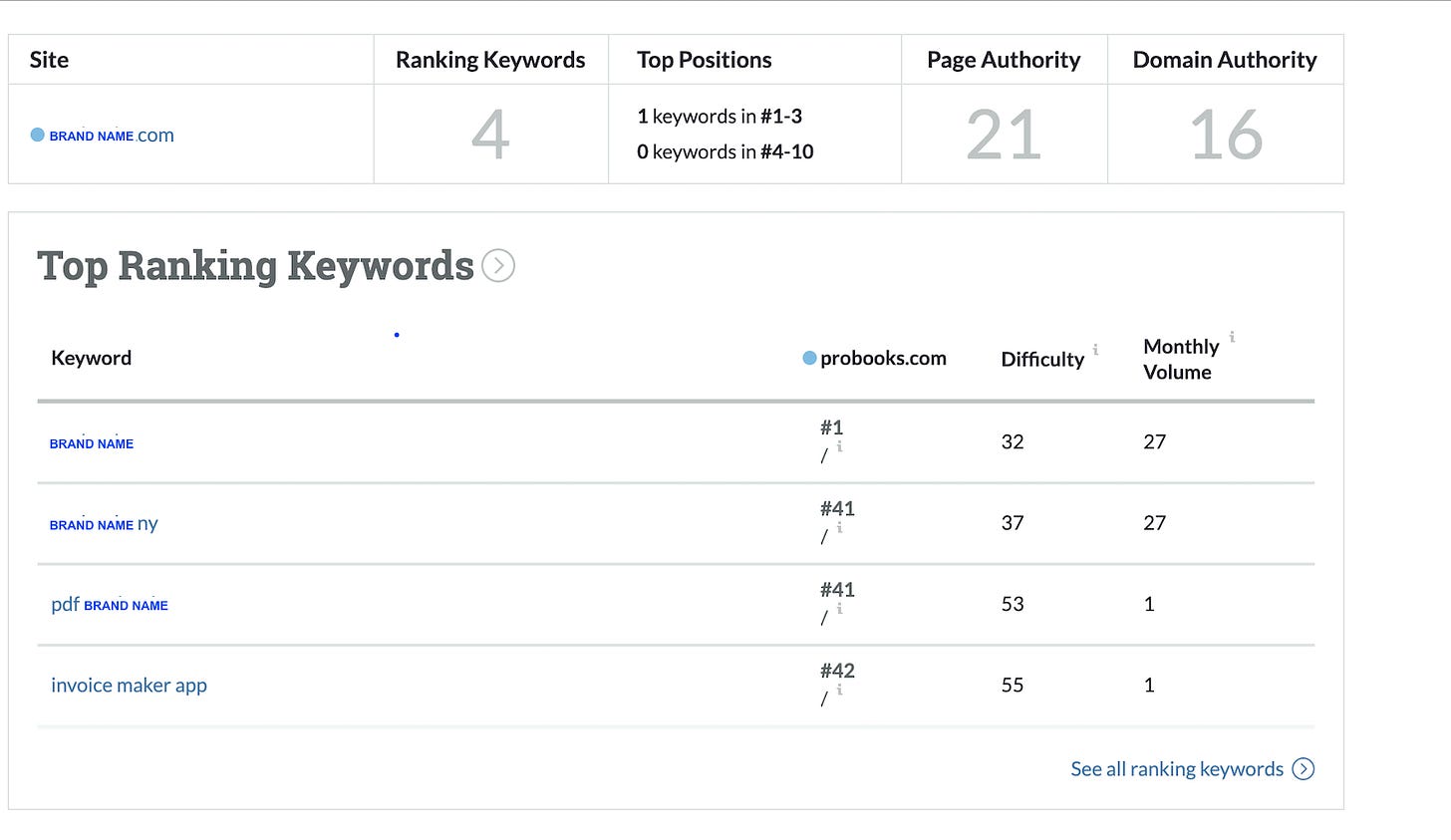

1. SEO

Rating (1-5): 1

💡 Before we give Ben’s take on the App’s SEO rating…What is SEO in the first place? Our friends at Wikipedia summarize it succinctly: “Search engine optimization(SEO) is the process of improving the quality and quantity of website traffic to a website or a web page from search engines.” In essence, the better your SEO, the more people will find you through their searches.

In this case, the app hardly gets users through SEO.

2. App Store Ranking

Rating (1-5): 3🥉

“While not a perfect method it appears that the app shows up for invoice maker and invoice app on the first page for android and is nowhere on the map for ios. On Android there is a free version of the app that acts like a lead gen tool for paying customers”

3. App Store Reviews

Rating (1-5): 4 🥈

Apple: 4.2 stars (21 Ratings)

Android: 4.7 stars (2,094 Ratings)

“Reviews seem authentic and the sentiment is positive. No major feature requests, no bug complaints, good support response time. Most one star reviews seem to be about being blindsided by a paid subscription. Worth noting that the Android user base is MUCH larger than iOS. The reviews are great. The app is obviously filling a need. There are a lot more users on Android than iOS which makes the future of this app a little riskier.”

💡 Significant discrepancy in reviews across Apple & Android. This is important because ideally you want many reviews on both apps. The more balanced it is, the more diversified your income stream —> The more diversified your income stream, the less risk you are taking on as a buyer.

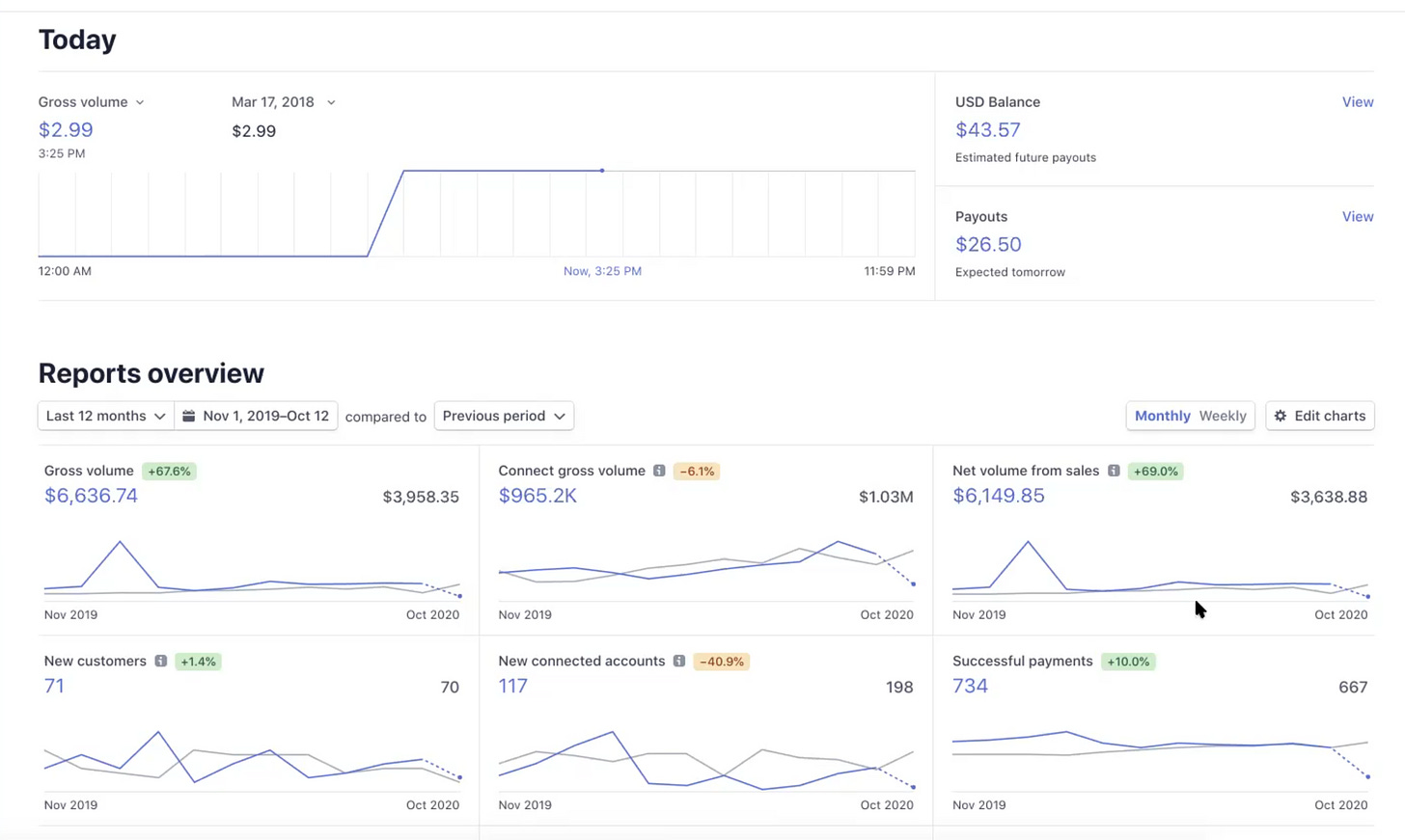

4. Key Metrics

Overall Rating (1-5): 3

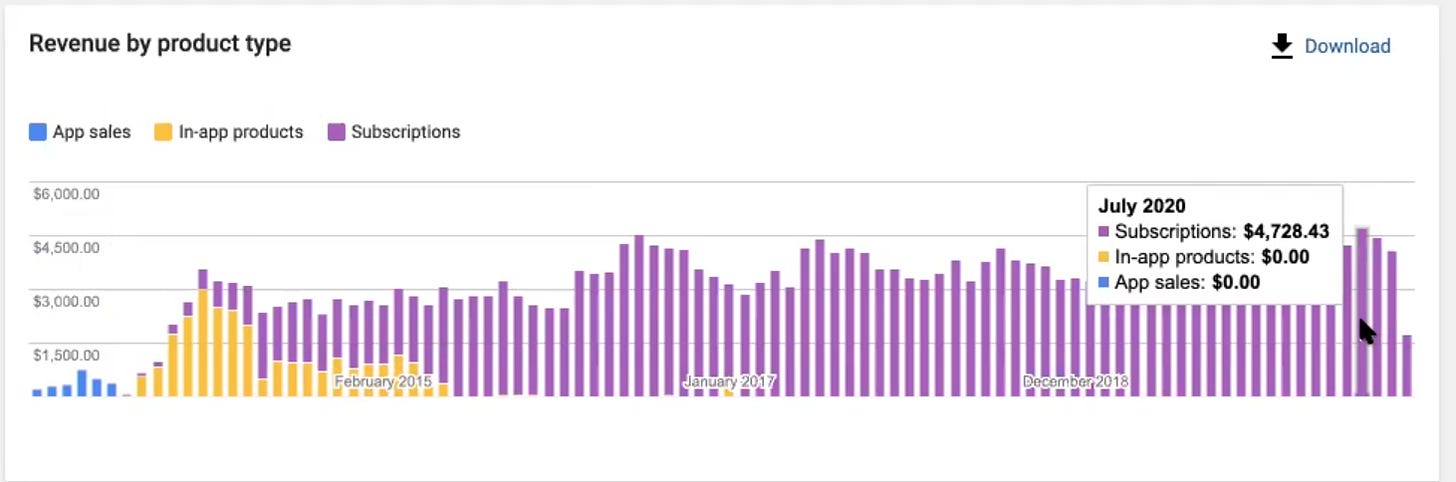

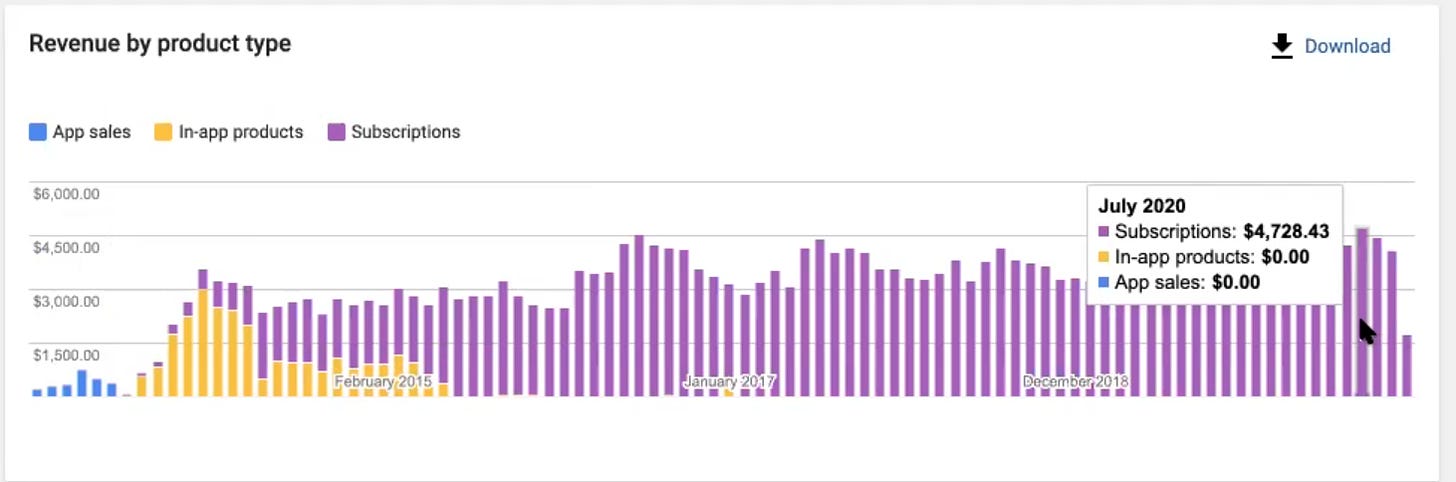

👍 Revenue is consistent and always has been

👍 Pandemic had minimal effect

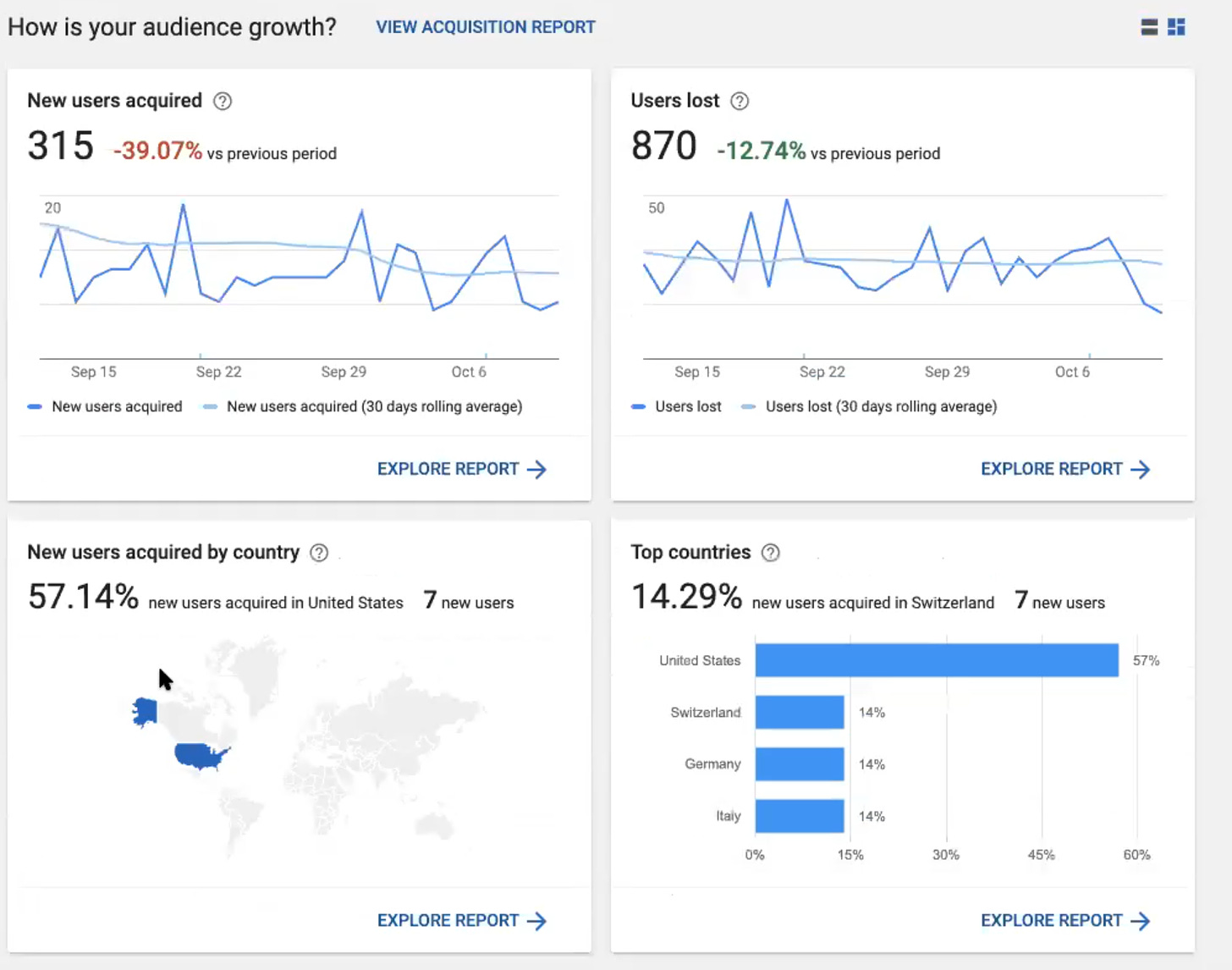

👎 New users are declining ~39%

💡 Oh oh…big red flag. Has their main customer segment been hit hard? Have they found a better app? Have the founders gotten distracted?

❓ There has never been a large growth period

👎 iOS has 1/4 of the user-base

👍 Nearly $1,000,000 in sales is passing through the platform every month

“Essentially the numbers show two key things:

There's an outsized dependance on Android

The user base is not growing and if anything…it is slowly shrinking

This is dangerous…A shrinking set of customers, deep-pocketed competitors, and a lot of feature ground to catch up. I think we found our 🐲.”

💡 Knowing what metrics to look out for while analyzing a business is key. Otherwise one runs the risk of leaving important details out.

5. Tech Stack and Health 👨⚕️

Rating (1-5): 4

Web: Angular

iOS: React Native

Android: Native

Payment: Stripe

Backend: The app appears to be fairly robust because it makes use of an event driven design. Although we wont know until we get our hands dirty in the code. Also the error rate in the android dashboard is about 0.3% in the last year.

My only concern is that the surface area of this product is large. Adding net new features will require potentially touching 5 different code bases which for a team of 1-2 devs could become cumbersome and expensive. 💸

6. Competition 🤼🏿♂️

Rating (1-5): 1

"There is a lot of competition and many of them are big.

Many 🦍's in the space and many of them offer free and fully-featured versions:

They also offer features this app does not have:

Overdue reminders

eSignatures

Brand-able client portals

Time Tracking

Accounting integrations

Customer terms of service

💡 Ouch…hard to compete against free and better.

7. Customer Support 🎧

Rating (1-5): 4

On average the app receives 2.5 emails a day and likely requires 10 hours of effort a month. There's an approximate profit of $3000/month which means we're making $300/hr for our support efforts, well above the $50/hour target

8. Marketing Opportunity 📩

Rating (1-5): 5

The website is hideous, has no product screenshots and the product could use a fresh coat of paint.

Also, no effort has been put into any marketing campaigns or customer interviews.

Theres a lot of land yet to be tilled here. 🌱

💡 Another way to look at this drawback is that it is low hanging fruit. 🥭

9. Miscellaneous Notes from Seller Conversation ✍

Been around for 7 years

50% of customer are from the USA the other 50% from Europe

Localized in French, Italian, and Portuguese

The free version is ad monetized

Invoices are customizable with a logo

Much of the revenue comes from existing long term customers

Price increase 6 months ago didn't cause a lot of churn

💡 I like that it has been around for 7 years and that it has a 50% USA & Europe customer base. The other aspect that stood out is that 6 months ago they increased the price for the paid version of the app and there was minimal churn.

SWOT(Strengths, Weaknesses, Opportunities & Threats) Analysis 👮

We have enough information to do a basic SWOT analysis to set the stage for thinking about whether or not this is a good purchase.

Strengths 👍

Long term paying customers with low churn

Good ratings on both platforms

Strong ranking in Android

Customers are price insensitive so far

Strong domain name

A lot of features built so far

Weaknesses 👎

New customers are going down

New connected stripe accounts are going down

A LOT of competition, many of them are 1000 pound silver back gorillas

Lacking in features

A lot of dependence on Android.

No integrations

UI is outdated

App Stores take a healthy cut of profits

Opportunities 🧠

Raise prices further

Take a percentage of payments through the platform

Add a fresh coat of paint and start marketing to a niche? (What niche though?)

Threats 😧

We lose our ranking on android

Adding features becomes too expensive

We cannot fight the natural currents of the invoicing industry and lose customers

The Evaluation 📝

1. Product Rating - Rating (1-5): 4

Whats the core of the product like? Is it already solving a need and built in a way we can extend?

It is solving a need but many other products are doing the same.

2. Hows the tech stack?

The tech stack is solid, no risks besides it potentially being too complex for a small team.

3. How does pricing compare?

The pricing is good, lower than the competition and the lack of churn after a price increase is a good thing.

4. How big of a problem does it solve?

A very large problem. 90% of small businesses need to send invoices.

5. Are people paying for it?

People are paying for it, consistently and on a long term basis. Though less and less people are coming in fresh.

6. Time Scale - Rating (1-5): 4

What stage is it in? Does it have at least a year of metrics to back itself up? Is the founder just starting or burnt out?

We have metrics going back 5 years showing a stable user base. Though the metrics indicate minimal room for organic growth.

7. Five Forces - Rating (1-5): 1

8. Are there any substitute products out there?

Hundreds.

9. Whats the competitive landscape?

Plenty of direct and indirect competitors.

10. Are there any vendor dependencies?

Currently on android until we can get web and iOS user bases up. Besides that? The old version of firebase could be considered a vendor dependency.

11. What would it take for someone to replicate the product?

While it’s an easy to understand product, the owner has built a lot and for someone to replicate it on their own I imagine it taking at least 6 months.

12. Growth Plan - Rating (1-5): 1

What would we do to grow this if we bought it?

Growing this is a tough one IMO. I don't feel like I have the information for it yet.

I could say its just a matter of adding:

Accounting software integrations

Branded payment portals

Automated Invoice overdue follow ups

Adding it to comparison sites

But really that feels like the Field of Dreams Fallacy. To have a shot at growing this app I would first need to get a hold of the customers to find out:

Why are they choosing the product?

What is their profession?

What is the app missing for them?

I would add: “What made them stick with this app?” & “What got them to download and pay for the app”

After that I'd hope we could identify a small niche to serve and hyper-focus the app around them. Then move into some targeted campaigns around that niche. Though that highly depends whether this app is currently serving a niche, or is it just a hold out from the days when there wasn't as much competition? It's unclear but it is a gamble.

Overall I'm not confident I can say to potential customers that we're the best option for them. This makes it hard to be an honest marketer and truly serve your customers needs."

Overall Score: 2.5 👎

Looking Back at Our Wishlist 📋

✔️ It must have one paying customer

❌ The purchase price should be no more that 4x ARR

✔️ It cannot be replicate-able by no-code products

✔️ Opportunity for Expansion Revenue and Net Negative Churn

✔️ Support Time Per hour / Profit per hour should not be below $20

While the app is in a stable position it's priced too high.

This is for two reasons:

It's not growing, and overtime with no attention will start shrinking as OG users churn.

To get it growing it will take significant development and marketing investment. This isn't a 3 month turn around.

A purchaser with a background in customer interviews and marketing could make a great run at discovering the niche it fills and refocusing the product.

A good next step for a potential buyer would be to ask if you could run a survey on the current users. - Jordan Schuster.

Would your friends benefit from reading this diligence process? If so… why not share it? :)

My lawyers told me to include this:

This newsletter is presented for informational purposes and educational purposes only and should not be construed as professional financial advice. Should you need such advice, consult a licensed financial or tax advisor. The newsletter is composed of opinions and is not intended to give investment advice.